Conventional and Shariah-Compliant Savings Option of Employees Provident Fund: A Monetary Comparison on the Dividend

Keywords:

Conventional, shariah, employees provident fund, Islamic investment, dividendAbstract

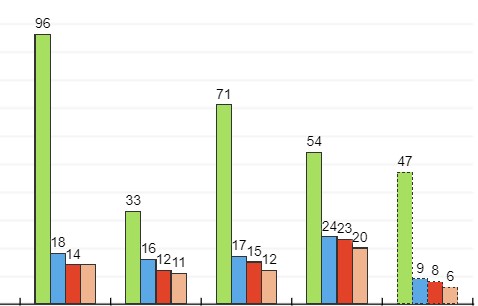

The aim of this study is to investigate the financial gap in dividend payments for investors between the conventional and Shariah-Compliant Savings Options offered by the Employees Provident Fund. This research objective derived from the research question on what the profitability of the Muslim investors investing in the conventional and Shariah-Compliant Savings Options. This is important as the amount and rate of the Shariah saving plan among Muslims are still considered low and slow while it is compulsory for the Muslim to opt the Shariah-Compliant Savings Options. The analysis will be done through the formula run by Microsoft Excel. It is relying on data sourced from official statements and reports provided by government agencies, specifically the Employees Provident Fund's official website. The calculations provided proved that Muslim investors stand to receive a higher net dividend by choosing the Shariah-Compliant Savings Option. It is essential to encourage Muslim investors to switch to this option, as it could result in higher dividends and is considered blessed by Allah. Future studies could discover the cases seeking exemption from the purification process for conventional investments, as deliberated by Islamic authorities in Malaysia.